The one phrase reply to this query is — Yesterday.

Allow us to now attempt to clarify to you why we are saying this. Most frequently potential buyers have this query about getting the timing proper.

A number of them even say — ‘Let the suitable time comes, I’ll begin investing.’

Why can we need to time the market? Possibly as a result of we need to purchase on the backside and promote on the prime. However, the everlasting reality is — Simply two individuals should purchase within the backside and promote within the High — One is GOD and different is Liar.

Frankly talking, none of us can predict the market or proper time for the funding. For an investor to even suppose they will time the market is a futile train. No-one provides you with an award for this. Additionally, ready for the suitable time and delaying investing will value you dearly. How? That we’ll present you within the instance under.

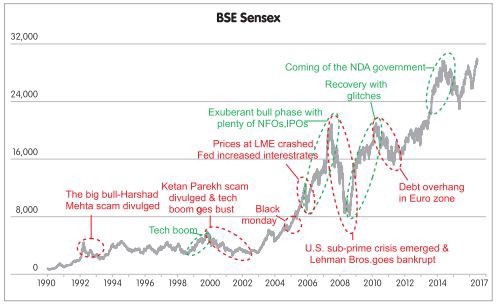

The BSE Sensex, a benchmark that signifies the inventory market, was 1160 on March 14, 1991. It’s at present (fifteenth March 2019) round 38,000. This quantities to an annualized development of almost 13.04%.

Throughout this era, most of what may go mistaken did go mistaken, each on the native and world entrance. But, those that invested at the moment and held on, have multiplied cash by over 32 occasions (in roughly 27 years). Those that tried to time the markets had been typically left annoyed.

Furthermore, research have proven that those that keep away from useless exercise and keep invested throughout market cycles, not solely take pleasure in extra peace of thoughts but in addition find yourself wealthier.

We appeared on the investing journey of three buyers who began investing in numerous market eventualities and continued funding until immediately.

- Investor A began month-to-month investments in Rs. 10,000 January 2007 when the market was in the course of a bull run, nearly a yr earlier than the recession hit and markets crashed.

- Investor B began month-to-month investments in Rs. 10,000 in January 2008, when the market was at their peak, anticipating the development to proceed however that was the time markets began correcting.

- Investor C, waited until the center of 2009 (March 2009) for the market to get better earlier than starting his SIP of Rs. 10,000.

Here’s what we discovered –

For all of the three buyers, the CAGR or common annual return was inside a .5% distinction. Whereas investor A noticed his cash develop at 11.42% yearly, investor B received yearly returns of 11.87% and investor C with 11.90%.

However if you happen to have a look at the ultimate corpus they’d, you begin seeing how beginning early and staying invested is all that issues.

Investor A constructed a corpus of 30.61 lakhs, Investor B constructed a corpus of 27.06 lakhs and Investor C simply 22.52 lakhs.

The investor C needed about 28 lakhs for a aim however couldn’t get there as he waited for an ideal time to begin.

Even if you happen to began in January 2007, what in hindsight was the worst time to start (as markets had been nearing the top of a bull run), you’d have been higher off with a better corpus than ready. However you wanted to maintain investing by means of the powerful durations, and that’s the one factor that issues in investing!

The Backside Line:-

A prudent investor is one who relatively than ready for the suitable time, begin early and stays invested for the long run which permits his cash to compound. As Warren Buffett, has repeatedly emphasised on long run funding advantages. His quote- “In case you aren’t interested by proudly owning a inventory for 10 years, don’t even take into consideration proudly owning it for 10 minutes” offers you gravity concerning the significance of holding your investments for long run.

Yesterday was the very best day to start your funding, if you happen to missed it, it’s best to begin your funding immediately. Delay it additional simply within the occasion you need to forgo further returns.