One thing that is the basis of an investor’s decision to invest, exit, or invest more in any financial product is “Returns”. How much returns a Mutual Fund, stock or portfolio has delivered is one thing we always want to know before making any decision related to investing in the product. Therefore, ET Money decided to give investors a comprehensive picture of the performance of the different Genius strategies.

Our endeavor is to ensure complete transparency and provide as much information as possible to aid your decision-making process. So, we have made the back-tested returns data easily available on each Genius portfolio page.

In this blog, we will discuss, the different types of returns data that you can see on each ET Money Genius portfolio page and how you can use this information to select the best investment option for you.

ET Money Genius Portfolio Returns

Each ET Money Genius portfolio page contains three different sets of returns data with comparison to the benchmark in every case. These are:

- Trailing Returns

- Rolling Returns and

- Calendar Year Returns

We have a separate blog where we have explained how these returns are calculated. You can read it here.

In the following sections, we will explain how you can interpret the returns data. This will help you get a better understanding of how the 6 customized strategies of ET Money Genius work and how they have performed over different time periods and in different market scenarios.

Trailing Returns Of Genius Portfolios And How To Interpret It

Trailing returns means returns delivered over a pre-determined time period. Trailing returns can be returns delivered over time period of 1 month, 6 months, 1 year, 3 years, 5 years and so on. Trailing returns helps you understand the compounding effect on your money invested over the long term.

We show trailing return on our ET Money Genius returns page, so that you can see how Genius strategies can help you compound your money over the long term.

ET Money Genius return page not only gives you the trailing returns of the individual portfolios but it also allows you to compare the trailing return over different time periods with the benchmark. You can also change the benchmark provided and compare the trailing returns of the portfolio against other fund categories.

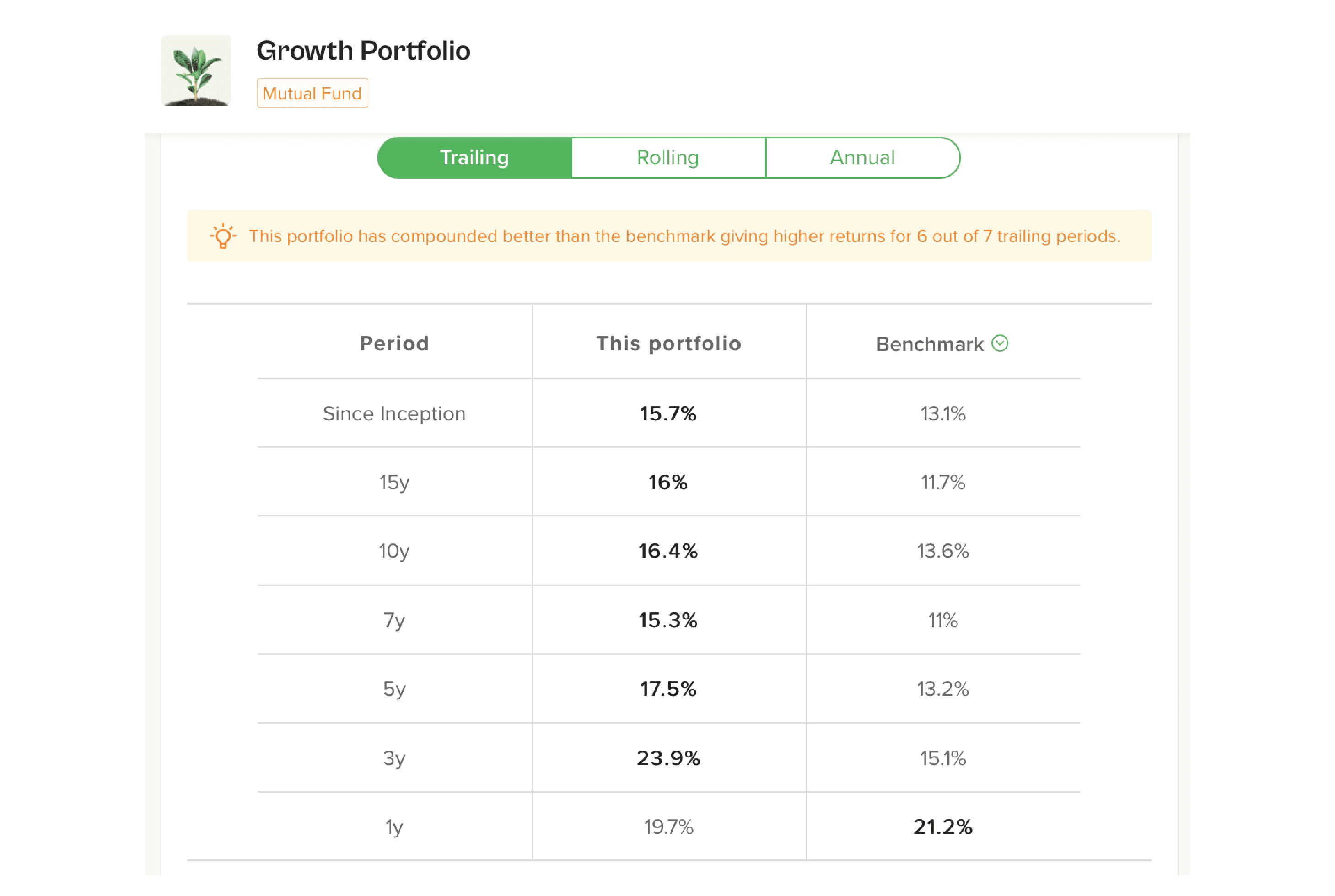

To understand this better, let’s consider the trailing returns provided by the Growth Portfolio. The Growth Portfolio can have a domestic Equity allocation of up to 80%, Gold up to 40%, International Equity of up to 15%, and a minimum Debt allocation of 15%. The benchmark for the Growth portfolio is the category average returns of Large Cap Funds. Here’s a comparison of the trailing returns:

As you can see, the ET Money Genius Growth Mutual Fund strategy has delivered better returns than benchmark over all time periods except for the very short 1 year period. But, you have to keep in mind that Growth portfolio is not suitable for an investment horizon of 1 year. So, by investing in this Genius portfolio for the long term, your money would have compounded at a faster rate compared to large-cap mutual funds.

As you can see, the ET Money Genius Growth Mutual Fund strategy has delivered better returns than benchmark over all time periods except for the very short 1 year period. But, you have to keep in mind that Growth portfolio is not suitable for an investment horizon of 1 year. So, by investing in this Genius portfolio for the long term, your money would have compounded at a faster rate compared to large-cap mutual funds.

Not only Growth strategy, if you compare the trailing returns of the other strategies as well, they have outperformed their respective benchmarks. So, no matter which strategy you invest in, you are likely to build more wealth by investing in a Genius portfolio.

Rolling Returns Of Genius Portfolios And How To Interpret It

Rolling returns are returns calculated on a continuous basis like daily, weekly or monthly for a fixed period. Let’s understand this with an example. Suppose, you are looking at the performance of a fund over the past 20 years. Rolling returns will help you understand, what kind of return you would have earned if you had invested on any day in the past 20 years for a 5-year investment period.

By looking at the rolling returns, you can get an idea of what kind of the return you can expect from the fund for the particular investment period. It basically gives you the probability of earning a rate of return from your investment.

Let’s understand this with an example of the ET Money Genius portfolio of Mutual Funds.

For example, consider the rolling returns of the Growth portfolio. The median return is arrived at after calculating the return let’s say over 3 years on a daily basis since the launch of the fund. And the next column “Chances of >8% Return” tells you that since the launch of the fund, on how many occasions the fund has delivered above 8% return for a 3 year investment period:

As you can see, ET Money Genius Growth portfolio has always delivered inflation-beating return that is above 8% for a longer investment tenure of above 5 years. So, the back-tested returns data of the Growth portfolio from 2006 to 2021 clearly shows that as long as an investor stayed invested for 5 years or longer, the investment grew faster than inflation and FD returns. As you can see, the median rolling returns of this portfolio have never been lower than 13% over any time period.

However, the chances are lower for the same portfolio beating inflation or FD returns when the investment period is shorter than 5 years. This is because the Growth portfolio is not meant for short investment periods. You may witness volatility in shorter period but over long term it will reward you with better returns.

Calendar Year Returns Of Genius Portfolios And How To Interpret It

Calendar year returns are self-explanatory. It gives you the ET Money Genius portfolio’s yearly returns. Looking at year-on-year returns can help you understand how consistently the fund has performed. Annual returns are often used to make the comparison with benchmark returns. We have provided the data for such a comparison. By comparing the portfolio’s annual returns to its benchmark returns, you can get a clear picture of the consistency of its performance.

The below screenshot shows the calendar year returns of the Growth portfolio versus its benchmark:

So on a calendar year basis, you would find that the ET Money Genius Growth Portfolio has outperformed the benchmark on most occasions. However, during a few calendar years, the large-cap category has delivered better returns than the Genius portfolio. But when it comes to downside protection, Genius Growth portfolio has beaten Large Cap Funds hands down on every occasion. In 2011, when large cap funds were down 24%, Genius portfolio was down by only 1%. Similarly, in 2008, Genius portfolio was down only 30% while Large-cap funds lost half of their value.

This clearly illustrates the core philosophy of ET Money Genius. Its brilliant downside protection capability helps generate alpha for long-term investors. We have done this by building each Genius portfolio using a mix of asset classes rather than giving a pure equity portfolio like large-cap funds. So, all Genius portfolios including the Growth portfolios have four asset classes – Equity, Debt, Gold, and International Equities. Genius manages the risk by doing the asset allocation right. This helps it deliver better risk-adjusted returns than a pure large-cap portfolio or any other asset class like gold or debt.

How To Analyze Different Types Of Genius Portfolio Returns

Whenever you are evaluating an investment product’s return, you should look at different return parameters to see how the fund or portfolio has performed across different market cycles or market conditions. The comprehensive information provided by us on the Genius page will help investors have all kinds of information they want to understand how Genius portfolios have performed in the past.