Because the lunch hour within the canteen turned noisier with IPL fever gripping everybody, Rahul nudged Atul to ask if he knew something about cryptocurrencies. There was an advert for cryptos in each match after virtually 2-3 overs. Are they dependable? Do they generate critical returns? Ought to one take into account them for investments?

Whereas Atul wasn’t too useful to Rahul about any of those questions, let’s throw some mild on a few of your queries concerning this new phenomenon that everybody needs to learn about.

What are Cryptocurrencies?

Cryptocurrencies are a kind of eCash or a digital foreign money designed utilizing blockchain expertise to be used over the web solely. Not like conventional currencies like Rupee or Greenback, you gained’t see bodily cash or foreign money notes for cryptocurrency. Similar to you maintain foreign money or cash in your checking account and see it in web banking, you possibly can maintain these cryptocurrencies in your digital pockets or an account tagged to your electronic mail account and cell quantity. You possibly can entry these by way of a cell, laptop or laptop computer so long as you could have web.

Whereas central banks and governments management fiat currencies just like the Indian Rupee or the US Greenback, cryptocurrencies are decentralised and are managed by lots of & 1000’s of computer systems related to one another as friends and operating on free, open-source software program. Since they’re decentralised and never restricted by nationwide borders, anybody who has web entry can use cryptocurrencies.

Among the hottest cryptocurrencies in the present day that you might have heard about are Bitcoin, Ethereum, Litecoin, Dogecoin, and so on.

How Does A Cryptocurrency Work?

Perhaps a decade or two in the past, you’d’ve handed over rupees to a vendor in your buy of merchandise. Now, you could pay in your purchases by swiping your credit score/debit card or sending cash by scanning the UPI QR code.

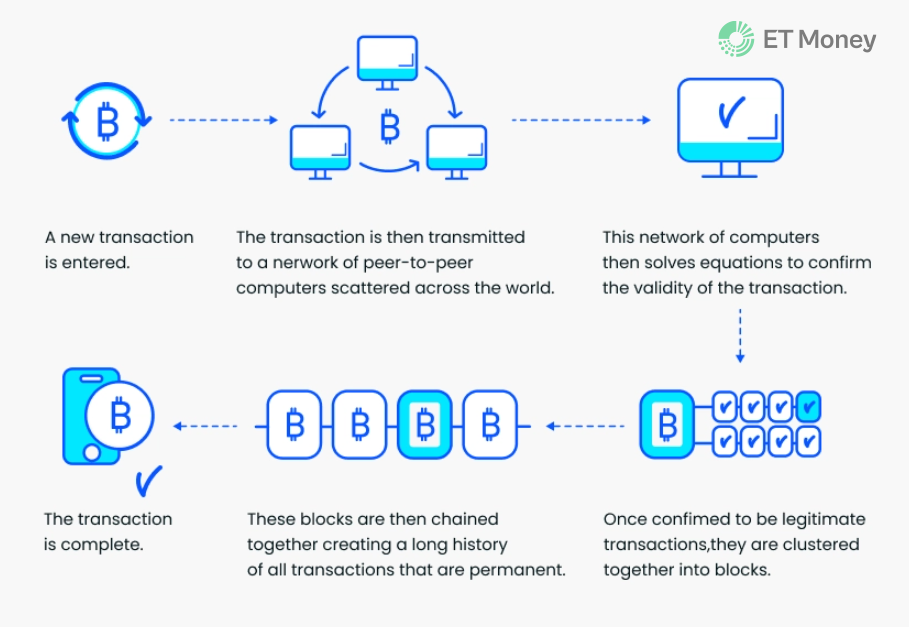

Within the crypto world, all the pieces is so utterly digitized that if you transact, bitcoin (or one other cryptocurrency) transfer out of your digital account or pockets (or electronic mail tackle) to a vendor’s account upon coming into your credentials into your system together with the seller’s account (or electronic mail tackle). Each time you switch bitcoins (or some other cryptocurrency), the transaction file is added right into a public registry of transactions for the foreign money (on this case Bitcoin) by a community of computer systems referred to as nodes engaged on this cryptocurrency platform. The worth of the foreign money modifications after each file is added.

This good piece of expertise or program that data thousands and thousands of transactions unfold the world over, verifies them and permits them to be settled seamlessly is named a blockchain. Each cryptocurrency has its personal blockchain code that determines its utilization and development.

The worth of cryptocurrencies retains fluctuating primarily based on the demand and provide of that foreign money, similar to it occurs for US {Dollars} or Euros. The massive distinction is that whereas US {Dollars} & Euros have actual world use in the present day and are nonetheless thought of dependable investments, cryptocurrencies expertise considerably excessive volatility and are nonetheless struggling to search out actual world acceptance as a foreign money.

How Are Cryptocurrencies Created?

Within the case of bodily currencies, central banks (like RBI) print foreign money notes or mint cash. The case of cryptocurrency, it’s created by laptop code. The code of the foreign money defines how the brand new cash will come into being. In idea, anybody can create their very own cryptocurrency utilizing blockchain and there are over 6500 cryptocurrencies that exist globally.

The creation of latest cash is linked to a course of referred to as ‘mining’, and it occurs solely when transactions are confirmed. It’s small algorithmic jobs (like verification and matching of transactions) that the community computer systems are required to do to be rewarded by an applicable quantity of foreign money. This, in fact, isn’t as straightforward and worthwhile for the common individual because it sounds. For instance, it’s estimated that 0.21% of all the world’s electrical energy goes to powering Bitcoin farms alone.

Although mining is the most well-liked type of new coin era, relying on the code of the cryptocurrency, different procedures to generate new cash additionally embody rewarding its builders with extra cash for varied jobs accomplished and even rewarding extra cash as curiosity on its current holdings.

What Are The Totally different Sorts Of Cryptocurrencies?

There are over 6,500 crypto currencies in existence as of September 2021. Nonetheless, not all are as in style or broadly obtainable as Bitcoin, Litecoin, Ethereum, and so on. Personal organizations and people are free to create their very own currencies, and there’s no restrict on the utmost variety of currencies. Additionally it is essential to notice right here that there’s nonetheless no readability or acceptance concerning the authorized tender standing of those currencies in lots of international locations.

Among the hottest ones are listed right here –

- Bitcoin

- Ethereum (ETH)

- Litecoin (LTC)

- Cardano (ADA)

- Polkadot (DOT)

- Bitcoin Money (BCH)

- Stellar (XLM)

- Chainlink (LINK)

- Binance Coin (BNB)

- Tether (USDT)

Can You Use Cryptocurrency In India?

Few world organizations have began accepting cryptocurrencies in alternate for his or her items and providers, cost platforms like Paypal have additionally began accepting them as a cost medium alongside bank cards and financial institution accounts.

Nonetheless, in India, few organizations at the moment settle for cryptocurrencies. So in all practicality, you can not freely purchase items & providers in India utilizing bitcoins or some other Cryptos but. Nonetheless, a number of small e-commerce firms, a restaurant, a rug vendor & a tattoo studio have began accepting bitcoins to indicate solidarity with digital currencies or make a advertising and marketing assertion. Keep in mind, cryptocurrencies are nonetheless not authorized tender in India. Even in case you are contemplating utilizing them for some offshore buy, you should be conscious that these currencies are extremely risky and, therefore, it’s worthwhile to ensure if you use them for consumption. You don’t need to find yourself paying like Laszlo Hanyecz in your buy!

Taxation of cryptocurrency

Since these cryptocurrencies usually are not but thought of authorized tender, these currencies’ good points are speculative good points. They are going to be topic to 30% flat taxation together with relevant surcharge & 4% cess. Additional, each citizen is obligated to report if any transactions in these cryptocurrencies lead to good points.

Efficiency of Cryptocurrency

Whereas we now have defined a few of the essential ideas concerning cryptocurrencies, Rahul and Atul are nonetheless interested by crypto-investing since there are simply so many ads for a similar and folks speaking about Bitcoin investing.

Cryptocurrencies, for instance, Bitcoins (BTC), are very new funding devices with a historical past of hardly 12-13 years. During the last decade, BTC has delivered over 230% p.a., greater than ten instances the subsequent finest performing funding – the Nasdaq100 index in US, which delivered 20% p.a. over the identical interval. Indian market (Nifty 50 Index) has delivered 4.54% p.a. solely (in USD phrases) on this interval. Merely put, for each Rupee of return made in Nifty, Bitcoin would’ve returned a whopping Rs 50.81. Nonetheless, these mind-boggling returns conceal the larger image of dangers, which is of utmost significance for any investor.

On this graph, we will have rebased the costs of bitcoin and BSE Sensex to examine the volatility of Sensex and Bitcoin. We are able to see that the bitcoin costs within the final three years have been very risky when in comparison with Sensex.

Dangers Related With Cryptocurrency Investing

Rahul and Atul, who’re nonetheless younger executives and eager to step by step construct their financial savings pool, want to know this can be a very new phenomenon. There may be little analysis and fundamentals obtainable for cryptocurrencies. One should undertake a good quantity of analysis to totally perceive how every foreign money works and the dangers related to such investments. One should not overlook that Bitcoin had nose-dived over 30% in single buying and selling classes solely due to easy tweets by Elon Musk. Since reaching its lifetime excessive in November 2021, Bitcoin is already down ~28% in lower than a month. Alongside virtually each different cryptocurrency has additionally crashed equally. This asset class is without doubt one of the most risky monetary merchandise and might lose worth in a single day.

Among the different key dangers and issues related to crypto investing are –

- Illiquidity – Not all of those currencies usually are not very regularly traded. Other than the highest 3-4 currencies, there’s very rare buying and selling with extensive worth fluctuation.

- Excessive value of buying and selling – Even when a few of the currencies are properly traded, as a consequence of restricted establishments collaborating & lack of market-making, the price of buying and selling can vary from 2% – 10% relying on quantity and can eat into your income.

- Lack of laws – Whereas investing, one wants an environment friendly alternate to commerce on. Not like mainstream investments like Mutual Funds there aren’t any legal guidelines to acknowledge or regulate the transfers & buying and selling in these currencies in India. Therefore, you might be on the mercy of those exchanges and their insurance policies concerning the assorted prices of buying and selling and the belief of good points.

Backside Line

Whereas Rahul & Atul just like the adrenaline rush that IPL matches present, additionally they need to watch out with their financial savings. As we mentioned above, Cryptocurrencies are an progressive improvement within the monetary world. It could be worthwhile to review them carefully earlier than being lured into an funding the place dangers are extra obvious than the present rewards.

We strongly advocate you to steer clear of these, as these are extremely dangerous and no less than till any kind of readability emerges with respect to laws and acceptance in day-to-day commerce & commerce. When you nonetheless need to enterprise out and take a look at the waters, you must do this solely with the amount of cash that you’re keen to lose over the subsequent few years.